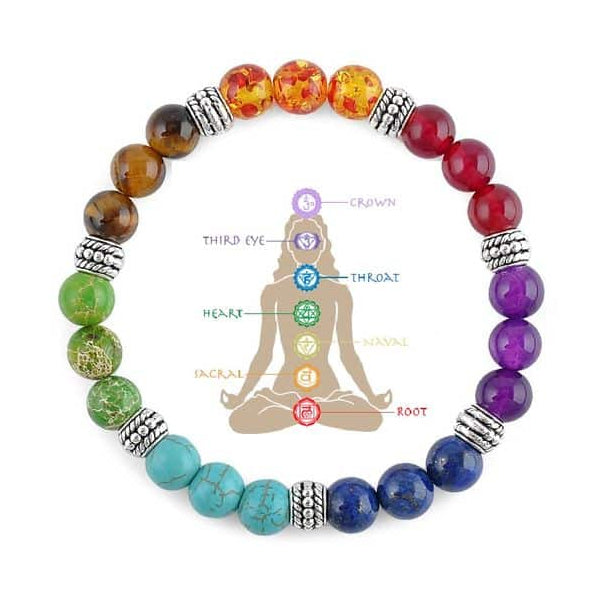

First Nations Tax Relief Form & FAQs

Q: Can I use my Indian Status Tax Exemption card online?

A: This is what the Canada Revenue Agency (CRA) has to say:

Sales over the telephone, Internet and other electronic means

“Vendors who make sales to Indians, Indian bands or band-empowered entities over the telephone or electronically must also maintain documentary evidence to show that the sale is relieved of tax. Since Indians cannot show their original status card or TCRD, and Indian bands and band-empowered entities cannot provide appropriate certification, when they make a purchase over the telephone or electronically, the CRA has taken the position that, to support their entitlement for tax relief, purchasers may subsequently provide a photocopy of their status card or TCRD (for Indians) or certification (for Indian bands or band-empowered entities) by mail or electronically (e.g., over the internet or by facsimile)” (https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/b-039/gst-hst-administrative-policy-application-gst-hst-indians.html)

“When sales are made to Indians or bands, maintaining documentary evidence is only one of the conditions that must be met in order for the Indians and bands to receive relief of the GST/HST. The remaining conditions in TIB B-039 must also be met at the time of the sale. For example, if a vendor is located off a reserve and an Indian customer makes online purchases, tax relief is not available unless the goods are delivered to a reserve by the vendor or vendor's agent.” (http://www.cra-arc.gc.ca/E/pub/gi/gi-127/gi-127-e.html)

CRA Eligibility requirements for online sales (all 4 must be true):

- You are the holder of a valid Status Card

- You currently live on a Reserve

- The name on credit card used for payment must match the name on the statuts card

- The product(s) are to be shipped to a Reserve

- Before you place your order, you must fill out the Status Card Submission Form below, even if you have shopped in-store before. (The CRA rules and regulations are handled differently for online sales vs in-store sales).

- You must provide us (i-Bead Inc) with your First name, Last name, Phone number, Home address (which must be on a Reservation), City, Province, Postal code, Email address, and upload a copy of your Status card.

- We (i-Bead Inc) will then verify your information and create you a special customer profile which is fully tax exempt.

- If you currently have an online customer profile, it will be adjusted to reflect no tax. If you do not have an online account, your new customer profile will be sent as an invite via email. Follow the online instructions, and happy shopping.

NOTE: You must submit the form below and wait for confirmation before placing your order, we unfortunately can no longer alter or change your order after it has been placed online.

IMPORTANT: The CRA has implemented penalties, interest and fines associated with the misrepresentation and reporting of GST/HST for both individuals and vendors. (https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/16-2/penalties-interest.html)

For acceptable Status Cards, click HERE.

* i-Bead Inc & The Canada Revenue Agency (CRA) recognizes that many First Nations people in Canada prefer not to describe themselves as Indians. However, the term Indians is used in this publication because it has legal meaning in the Indian Act.

- Choosing a selection results in a full page refresh.